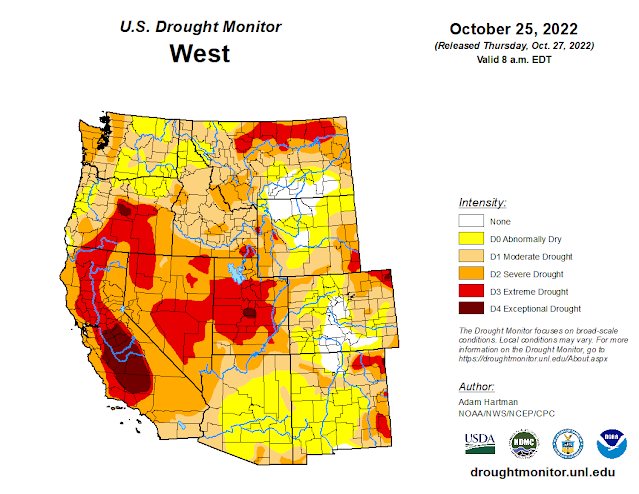

Much of the western half of the lower 48 states observed above-normal average temperatures this week. The Intermountain West and Pacific Northwest experienced the largest positive temperature anomalies, where widespread temperatures averaged 5°F to 10°F above-normal, with a few pockets exceeding 10°F above-normal for the week as whole. In addition to the above-normal temperatures, precipitation was also lacking for most areas from the Central and Northern Plains westward to the Pacific Coast, warranting drought deterioration. Parts of the Four Corners and Desert Southwest were the exception to this, as an area of low pressure meandered across the Southwest before being picked up by a frontal boundary dropping southward across the central U.S. This resulted in improvements to long-term drought conditions across parts of the Four Corners, with targeted improvements in the Southern Plains. Across the eastern half of the lower 48, frontal boundaries associated with a couple of strong low pressure systems in the Great Lakes brought heavy precipitation and cooler than normal temperatures to portions of the Great Lakes, Northeast, and Southeast. Therefore, a widespread mix of improvements and deterioration was warranted in many locations where the heaviest precipitation did and did not fall, respectively.

A couple of low pressure systems with trailing frontal boundaries resulted in another round of improvements to long-term drought conditions across New England and the Mid-Atlantic. Widespread 1 to 2 inch rainfall surpluses were observed across New England, with more than 4 inch surpluses in central and western Maine. Given the recent beneficial rainfall in many of these same areas, widespread 1-category improvements to the drought depiction were warranted. Some areas in western New York and south-central Pennsylvania have seen deficits creep up to between 1 and 3 inches over the past 30 days. So these areas will need to be watched in the coming weeks.

Large precipitation deficits have accumulated in many areas of the Southeast over the last 30 days, particularly across the southern Appalachians and much of the Gulf Coast states. Fortunately, beneficial heavy rainfall was observed across many areas in the Deep South and parts of the Tennessee Valley. 1-category improvements were warranted where 7-day rainfall totals in excess of 2 inches were able to eliminate 30-day deficits. Unfortunately, 30-day deficits of 1 to 2 inches still remain, even in areas receiving some of the heavier rainfall, warranting a status quo depiction in locations adjacent to areas showing improvement this week. Elsewhere across the Gulf Coast states, 30-day deficits continued to increase, warranting another round of deterioration this week. Parts of the Carolinas and Virginia continue to benefit from Hurricane Ian’s remnants from late September into early October. However, some pockets that didn’t receive the heavier rainfall amounts earlier this month, coupled with antecedent dryness leading up to Ian’s second landfall in South Carolina, resulted in targeted areas of D0 introduction across parts of the Coastal Plain and Piedmont of the Carolinas.

Frontal boundaries associated with a couple of strong low pressure systems over the Great Lakes brought heavy precipitation to parts of the Red River Valley of the South, the Ozarks, and the Tennessee Valley this week. Farther westward toward the Rio Grande Valley, a cutoff low pressure system became entrained into the second frontal boundary dropping southward across the central U.S. bringing heavy rainfall to parts of western and southern Texas. Improvements were generally warranted in areas receiving the heaviest rainfall (greater than 1 inch positive 7-day anomalies). However, antecedent 30-day dryness resulted in status quo depictions for several other locations receiving near to above-normal rainfall, as surface soil moisture has rapidly declined due to widespread 3 to 5 inch 30-day precipitation deficits and predominantly above-normal temperatures. This dryness also extends to 60 to 90 days for several areas across the Southern Plains and along the Gulf Coast, warranting 1-category deteriorations in the drought depiction for many locations not receiving rainfall this week.

Moderate rainfall over several days leading up to Tuesday (October 18), associated with a series of storm systems over the Great Lakes, resulted in targeted improvements to portions of western and northern Michigan and eastern Ohio this week. However, most areas, particularly along the Ohio and Middle and Upper Mississippi Valleys, experienced another round of degradation this week. Short-term (30 to 60-day) SPIs are widespread D1-equivalent (moderate drought) or worse across areas seeing degradation. Additionally, topsoil moisture continues to dry out across portions of the Ohio Valley and the Corn Belt. Deeper soil moisture remains very low also across much of the Mississippi Valley, with several soil moisture indicators (CPC Leaky Bucket, NASA SPoRT, and NASA GRACE) exhibiting large coverage of D1-equivalent (moderate drought) or worse soil moisture conditions along and west of the Mississippi River.

Despite the High Plains Region observing near to below-normal average temperatures this week, a combination of antecedent dryness, below-normal precipitation, and high winds resulted predominantly in continued degradation region-wide. The only exception was the southwestern corner of Colorado, where short and long-term drought indicators have shown continued improvement following a robust Southwest Monsoon season and a couple of additional episodes of precipitation, associated with cutoff areas of low pressure in the Southwest in recent weeks.

An upper-level low pressure system, coupled with a frontal boundary dropping southward across the central U.S. resulted in a good soaking this week for many areas from southeastern California eastward to the Rio Grande Valley. Given the lingering precipitation associated with this area of low pressure following the climatological end to a very robust Southwest Monsoon season in late September, this was another much-needed round of precipitation to further fuel ongoing improvements to long-term drought indicators, such as groundwater and 12 to 24-month SPIs. Soil moisture is in excellent shape as well coming out of the monsoon season across Arizona and New Mexico. Farther northward in the Western Region, degradation was the main story, as below-normal precipitation and above-normal average temperatures (in some cases record high temperatures for this time of year) were observed. High winds and above-normal temperatures resulted in targeted degradations across northern portions of the Intermountain West and the High Plains. In the Pacific Northwest, degradations were also warranted, with the addition of D2 (severe drought) across the parts of the Coastal Ranges and Northern Cascades in Washington, where 28-day average stream flows have dropped into the bottom 2 percent of the historical distribution. In addition, soil moisture ranks in the bottom 5 percent climatologically, vegetation indices are indicating widespread drought stress, groundwater levels are falling, and SPIs for all periods out to 120 days are D4-equivalent (exceptional drought). The Pacific Northwest is entering into a climatologically wetter time of year, so precipitation will need to come soon to halt further deterioration.

Despite some localized areas receiving below-normal precipitation over the last 30 days, Puerto Rico is still in good shape from a drought perspective due in part to the passage of Hurricane Fiona back in mid-September. Therefore, a status quo, drought-free depiction was again warranted this week throughout the entire island. However, USGS 7-day average stream flows have fallen a bit across eastern parts of the island and will need to be watched more closely in the coming weeks.

St. Thomas continued to be drought free this week. The Cyril E King Airport had 0.54 inch of rain this week, resulting in a month-to-date rainfall total of 1.01 inch or 35.1% of normal October rainfall. Year-to-date rainfall was 90.8% of normal at the airport. Most CoCoRaHS stations had less than half an inch of rain for the week, with the exception of the Anna's retreat (VI-ST-1) and Charlotte Amalie West 4.2 WNW (VI-ST-5) station which had 1.32 and 2.36 inches of rain, respectively. Month-to-date totals for some of these CoCoRaHS locations ranged between 1.51 to 4.15 inches. By the end of September, groundwater levels had improved, but since early October, groundwater levels are slowly decreasing. SPI value at the 1 month period was indicative of moderate drought, while the SPI values at 3, 6, 9, and 12 were indicative of drought free conditions.

St. John also continued to be drought free this week. Windswept Beach station had the most rain across the USVI with a total of 0.87 inch. The month-to-date rainfall total at the Windswept Beach was 2.10 inches or 64.5% of normal. The year-to-date total was 90.8% of normal. SPI values were indicative of drought free conditions at the 1, 3, 6, and 9 months, while the 12-month period was indicative of moderate drought.

St. Croix continued in long-term abnormally dry conditions since it had only 0.35 inch of rain this week at the Henry Rohlsen Airport. This was 1.43 inches or 56.3% of normal for the month-to-date. The year-to-date rainfall total was 1109.6% of normal. CoCoRaHS stations ranged between 0.18 to 0.71 inch of rain for the week. SPI values were indicative of drought free conditions across all three levels. Groundwater has improved some and is at similar levels last seen in Mar 2022.

Much of Alaska has received near to above-normal precipitation in the weeks and months leading up to this week, warranting a status quo, drought-free depiction again this week, as drought indicators generally remain in good shape.

In Hawaii, a low pressure system brought some enhanced rainfall to portions of the islands this week, adding to above-normal rainfall amounts received earlier in the month. Therefore, some targeted improvements were made to portions of Oahu and the Big Island. Unfortunately, degradation was also warranted this week for parts of Kauai and the southern tip of the Big Island, where stream flows and poor pasture conditions continue to be a concern, respectively.

Drought was not a concern across Palau since this was a very wet week with 4.10 inches at the Palau airport.

The Mariana Islands continued to be drought free. All three locations had over 3 inches of rain. The Rota Airport station had the most rainfall with a weekly total of 8.16 inches, this is a little over twice the monthly threshold to meet most water needs.

This was a wet week across much of the Federated States of Micronesia, with most locations receiving over 4 inches of rain. Yap had the most rainfall at 6.90 inches. Yap, Chuuk, Pohnpei, Kosrae, Nukuoro, Pingelap, and Woleai continued to be drought free.

Ulithi's drought classification was changed to drought free this week since its rainfall total was 5.18 inches and weekly rainfall totals have been over 2 inches since September 27. The October month-to-date rainfall total is 9.27 inches, surpassing the monthly threshold of 8 inches to meet most water needs.

Similarly, Lukunor's drought classification was also changed to drought free conditions since 4.36 inches of rain fell this week and over 2 inches of rain fell the previous two weeks, resulting in a month-to-date rainfall total of 8.86 inches.

Kapingamarangi continued to be in short-term and long-term severe drought since only 0.71 inch of rain fell and its month-to-date rainfall total is less than 2 inches.

Across the Marshall Islands, Alinglaplap, Majuro, Jaluit, and Mili had over 2-inches of rain this week, securing another week of drought free conditions. Kwajalein had 1.85 inches of rain for the week, resulting in a month-to-date rainfall total of 8.20 inches. Drought free conditions persisted across Kwajalein.

Following a week of no rain, Wotje had only 0.65 inch of rain for the week. Two consecutive weeks of little to no precipitation resulted in a month-to-date rainfall total of only 2.40 inches. Drought free conditions continued this week since drought impacts were not provided; however, if dry conditions persist next week, abnormally dry conditions might be introduced.

Short-term moderate drought continued across American Samoa this week since rainfall was 0.53 inch at Siufaga Ridge and 0.92 inch at Pago Pago. Both locations had less than 3 inches of rain for the month-to-date.

Looking Ahead

During the next five days (October 20-24), the storm system over the Great Lakes is forecast to move northeastward into Canada, but bring some additional light precipitation to parts of the northern and eastern Great Lakes. Surface high pressure is expected to dominate much of the eastern lower 48. However, a storm system is predicted to spin up off the coast of the Carolinas bringing the potential for rainfall along portions of the Eastern Seaboard. In the West, an active storm pattern is expected, with the potential for upwards of 3 inches of precipitation for the higher elevations of the Pacific Northwest and upwards of 2 inches across portions of the Intermountain West. The first of two systems is expected to intensify over the central U.S. leading up to October 24, bringing increased precipitation chances to much of the Great Plains and the Mississippi Valley. Below-normal temperatures are expected to shift eastward from the West Coast to the Great Plains, associated with the storm system entering the West during the weekend. Ahead of this system, southerly flow is expected to keep temperatures near and above-normal, with the largest anomalies shifting eastward from the Great Plains to the eastern U.S.

The Climate Prediction Center’s 6-10 day outlook (valid October 25-29), predicts increased chances of below-normal temperatures for southeastern Alaska and the western half of the contiguous U.S. (CONUS). Southerly flow and above-normal temperatures are favored from the Mississippi Valley to the East Coast. An active storm track is forecast across the Northeast Pacific, leading to above-normal precipitation odds across much of Alaska and extending into the Pacific Northwest. Low pressure is forecast to develop east of the Rockies bringing the potential for above-normal precipitation to much of the southeastern CONUS. Conversely, in the Southwest, below-normal precipitation is favored as the storm track is expected to remain farther northward.

.jpg)

.png)

.jpg)

.png)

.png)