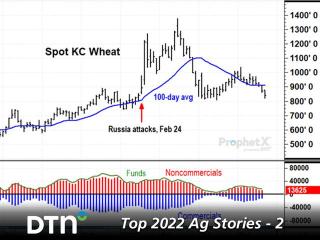

When thinking back to Feb. 24, 2022, the start of Russia's one-sided war against Ukraine, it is easy to forget wheat prices had already been trading near $8 and $9 a bushel, their highest levels since 2012. Prices had earlier been propped up in late 2021 by a spring wheat drought on both sides of the U.S.-Canadian border. U.S. wheat production totaled 1.646 billion bushels (bb) in 2021, the lowest in 19 years. Canada had a similar experience, watching wheat production drop 37% on the year to 22.3 million metric tons (mmt) or 819 million bushels (mb).

The hangover of logistics and production problems from the initial global pandemic in 2020, China's surprisingly large corn and soybean imports in 2021, North American drought in 2021 and Brazilian soybean drought in early 2022 all formed a cluster of unexpected bullish events that raised concerns about higher prices, even before Russia invaded.

In late 2021, when reports first surfaced of Russian troops along Ukraine's eastern border, my first thought was Russia's President Vladimir Putin was bluffing. It seemed in character for him to poke market fears and spur wheat prices higher. Even more important, the Russian treasury was getting a nice boost, while the world's second-largest exporter of crude oil conducted military drills near the border. Spot crude oil went from the low $60s in November 2021 to above $90 a barrel in the days leading up to the war. It looked like a scam.

As winter progressed, however, it became obvious Putin was not bluffing and I don't think many of us Westerners thought Ukrainians had a chance against Russia's war machine. Almost immediately, Kyiv was under attack and in March, things looked bad. Some in the media predicted Ukraine would fall in a matter of months.

Because Ukraine is one of the world's largest exporters of wheat, corn, barley and sunflower oil, it didn't take long for world markets to respond with higher grain prices. Ukraine's winter wheat crop had already been planted the previous fall and there were questions about what would happen at harvest. The Russian Navy quickly blocked Ukraine's access to the Black Sea.

Eventually, spot U.S. prices of corn would hit a high of $8.27 a bushel by April and Kansas City wheat would hit $13.79 1/4 by May, but grains were not the only rattled markets. In the U.S., spot crude oil hit a peak of $130.50 a barrel in March, DTN's national index of anhydrous ammonia prices were going for more than $1,500 a ton at planting time and spot natural gas hit a high of $10.03 per million British thermal units (Btu) in August -- all much higher-than-normal levels. Europe's energy prices soared even higher as Russia withheld natural gas.

In the U.S. and Europe, inflationary pressures -- that were simmering before the war -- become even more worrisome after Russia invaded, especially as oil prices shot higher. Central banks were forced to raise interest rates and, by June, Federal Reserve Chairman Powell was warning about the possibility of a recession. Putin's war didn't cause all the financial problems in the West, but it certainly added to them.

As we finish out the final days of 2022, we now see grain and energy prices have calmed down. The Ukrainian people have shown heroic grit and continue to fight for their lives and livelihoods, helped by arms and money from the West. Diplomatic efforts by the U.N. and Turkey convinced Russia to allow grain shipments to leave Ukraine through the Black Sea and has helped to maintain hope for Ukrainian farmers in extremely difficult conditions.

Even though prices have calmed from earlier peaks, at the time of this article, world supplies of wheat and oil remain historically tight and the nuclear plant at Zaporizhzhia remains in harm's way, having lost contact with the power grid several times.

After losing Kherson in southern Ukraine this fall, Russia's invasion is looking more like a disaster with each day that passes. According to BBC.com, a U.S. general said around 100,000 soldiers had been killed or wounded on both sides of the war. Russian GDP was reported down 4% in the third quarter from a year ago. Putin's attempt to increase the draft had to be scrapped after widespread protests erupted.

It is natural for people of good will to hope for the best, but it is difficult to say what Russia will do next -- the malevolent threat is not gone yet. Big challenges and risks in the world's grain and energy markets are still ahead of us in 2023.

.png)

No comments:

Post a Comment