Over the past week, a major heatwave brought warmer-than-normal temperatures to much of the West, with departures ranging between 3 to 12 degrees F above normal across much of the region. Near-normal to cooler-than-normal temperatures were observed from the central Rockies to the Great Lakes, with departures ranging between 3 to 9 degrees F below normal. Precipitation varied across the contiguous U.S. this week. Monsoonal moisture brought heavy precipitation and flash flooding to parts of the Southwest, while a lingering frontal boundary brought daily thunderstorms, heavy rainfall and flash flooding across much of the Southeast and Mid-Atlantic. The most widespread improvements were made in the Southeast, as well as eastern portions of the Southwest and across much of western Texas, where above-normal precipitation amounts were observed this past week. Conversely, dry conditions resulted in degradations across much of Hawaii and the Pacific Northwest, as well as southern portions of the Northeast and in parts of the central Plains, and other parts of the West. Drought and abnormal dryness also expanded or intensified in the Ohio Valley, western High Plains, and in New England. In Hawaii, dry conditions coupled with warmer temperatures resulted in the expansion and intensification of drought across the state this week.

Precipitation fell across most the of the Northeast this week, but amounts varied greatly across the region. Above-normal precipitation, with rainfall amounts between 200%-400% of normal, fell from central Pennsylvania to western Massachusetts, as well as parts of southern West Virginia and northern parts of New York and New Hampshire. Heavy rainfall totals allowed for improvements of abnormal dryness in parts of western Massachusetts and from eastern Maryland to southern New Jersey. Moderate to severe drought were also improved from central Maryland to south-central Pennsylvania, where above-normal precipitation fell. Most other areas were drier than normal, which resulted in the expansion and intensification of drought. Abnormal dryness was expanded in central New Hampshire and was introduced into southern Maine. Moderate to severe drought were expanded in Ohio, while moderate to exceptional drought were expanded in northern portions of West Virginia and western Maryland. For the week, average temperatures were near or above normal across most of the region with departures ranging from 1 to 6 degrees F above normal.

Temperatures were above normal across much of the Southeast this week, while portions of Alabama and Georgia observed below-normal temperatures. Heavy precipitation fell across much of the region this week, with the heaviest amounts of rainfall being observed across much of Alabama and North Carolina, as well as parts of southern Georgia and northern Florida. These areas reported weekly precipitation amounts between 300% to 600% above normal and ranged between 2 to 8 inches of rainfall over the past week. Drought reduction and improvement were based on precipitation amounts, short-term SPI/SPEI, NDMC short-term blends, and improvements to streamflow and soil moisture data. Based on these short-term indicators, widespread improvements to drought and abnormal dryness occurred in Alabama, Georgia, North Carolina, as well as southern portions of Virginia and northern portions of Florida. Precipitation amounts of up to 400% above normal were measured in parts of northern Florida and southern Georgia, resulting in the removal of drought from this area and making Florida free of drought.

Dry conditions continued across much of the northern portions of the South this week, while heavy precipitation fell across much of central Texas and in parts of northern Arkansas, with areas reporting rainfall totals greater than 600% of normal. Abnormal dryness was removed from northern Arkansas, while moderate to extreme drought were improved across much of central Texas. Improvements were also made to parts of northern and eastern Tennessee where spotty showers brought much needed relief, returning areas back to their 30-day precipitation normals. Conversely, conditions continued to deteriorate in parts of northern Kansas and parts of western Texas, where precipitation totals were 5% to 25% of normal for the past month. Moderate to severe drought were expanded into central Kansas, while extreme drought was expanded and exceptional drought was introduced into the Trans-Pecos region of Texas this week. Temperatures were below-normal across much of the South, while departures of 1 to 6 degrees F above normal were observed across parts of western Texas. The expansion and intensification of drought categories were based on short-term SPI/SPEI, reservoir levels, streamflow and soil moisture data.

Much of the Midwest remained free of drought and abnormal dryness this week, while average temperatures were well below normal across much of the region with departures ranging between 1 to 9 degrees F below normal. Precipitation was also below normal across much of the Midwest, resulting in the expansion and intensification of drought in eastern parts of the region. Moderate to severe drought was expanded in parts of eastern and southern Ohio. Improvements were made to southern parts of the region, where areas observed above-normal precipitation this week. Moderate drought and abnormal dryness were improved in southern Kentucky in areas the received rainfall amounts up to 400% of normal. Above-normal precipitation also allowed for improvements to abnormal dryness in parts of southern Illinois and southern Indiana this week.

Precipitation fell across much of the region this week, which was enough to prevent large areas of degradation but not enough to warrant large improvements. The heaviest rainfall amounts fell across much of eastern Colorado, reporting rainfall totals up to 400% of normal, resulting in the improvements of abnormal dryness and the removal of moderate drought from the region. Heavy precipitation amounts were also reported in central Nebraska and central South Dakota but were already free of drought and abnormal dryness this week. Precipitation was below-normal across the western portions of the region, resulting in the expansion and intensification of drought. Severe drought was added western South Dakota and Nebraska, and expanded in eastern Wyoming. Moderate drought also introduced in southwest Nebraska this week, while abnormal dryness was expanded in the area. Much of the region remains free of drought and abnormal dryness this week.

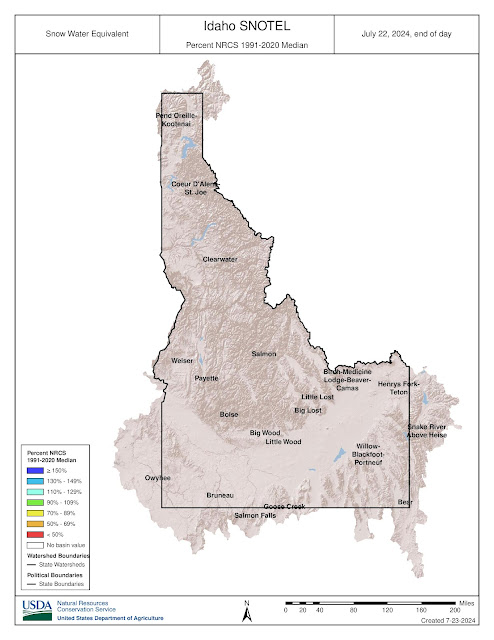

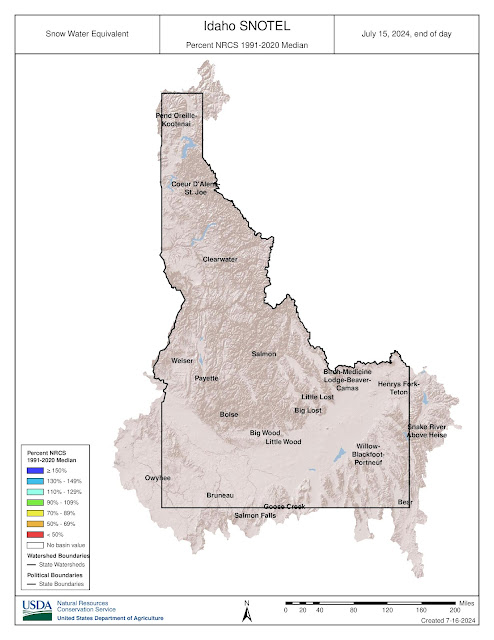

Average temperatures were well above normal across much of the West this week. Temperatures ranged between 3 to 9 degrees F above normal across much of the region, while northern portions of the region observed temperatures up to 12 degrees F above normal this week. Precipitation fell across much of the region but amounts were mostly below-normal for the region. The heaviest precipitation amounts were measured over parts of New Mexico. Above-normal precipitation (up to 6 inches), along with cooler temperatures, resulted in the removal of exceptional drought from southeast New Mexico and improvements to extreme drought, severe drought, moderate drought and abnormal dryness across eastern and southern portions of the state. Conversely, warmer-temperatures and below-normal precipitation resulted in the introduction of exceptional drought in western Montana, as well as the expansion of drought in other parts of Montana, across much of Oregon into northern California, while moderate drought was introduced in northwest Utah. The expansion of abnormal dryness occurred in parts of Nevada, which missed out on some of the beneficial rains resulting in the expansion of moderate drought in the area. Conditions remained dry in the interior parts of Washington, resulting in expansion of moderate drought and abnormal dryness based on short-term SPI/SPEI data, as well as low soil moisture and streamflow.

There were no changes made in Puerto Rico this week.

A generally wet pattern continued across the U.S. Virgin Islands, leaving the entire territory free of dryness and drought. During the drought-monitoring period, a network of volunteer (CoCoRaHS) observers noted rainfall totaling 0.99 to 1.29 inches on St. Thomas and 1.20 to 1.58 inches on St. John. Slightly drier weather prevailed on St. Croix, where totals ranged from 0.24 to 0.88 inch. Visual observations and the Vegetation Health Index (VHI) indicated that vegetation is much more lush than a year ago, when severe to extreme drought (D2 to D3) was plaguing the territory. Depth to groundwater at three U.S. Geological Survey wells has been relatively steady in recent weeks, and the Standardized Precipitation Index indicates that drought-free conditions exist for all time scales at each reliable observation site.

There were no changes made in Alaska this week.

Warm temperatures and dry conditions continued across much of Hawaii this week. Drought and abnormal dryness were expanded on Maui, Oahu, Lanai, Molokai and the Big Island, while moderate drought was introduced on Kauai.

Showery weather dominated the U.S.-Affiliated Pacific Islands, except American Samoa, where measurable rain last fell at Pago Pago International Airport on July 16. Still, enough rain has fallen in recent weeks to keep American Samoa free of dryness and drought. Drought-free conditions also existed in the Republic of Palau, where heavy showers were associated with disturbances that later coalesced into two Western Pacific tropical cyclones (Prapiroon and Gaemi). Meanwhile, most locations in the Federated States of Micronesia received significant rain during the drought-monitoring period. A long-running drought ended for Yap and Ulithi, with D0 mapped for both locations to reflect any lingering impacts. Drought-free conditions were last observed for Yap on December 19, 2023, and for Ulithi on November 28, 2023. Yap was particularly wet during the drought-monitoring period, with 9.45 inches reported, while Ulithi received rainfall totaling 2 inches or more for the seventh time in 8 weeks. In the Marianas, abnormal dryness (D0) was retained for Saipan, while drought recovery has been more complete for Rota and Guam. Finally, in the Republic of the Marshall Islands, extreme drought (D3) was retained for Wotje, despite 2.00 inches of rain during the drought-monitoring period. That marked Wotje’s greatest weekly rainfall since late-May 2024.

Looking Ahead

During the next five days (July 23–27, 2024), dangerous heat is expected to continue through the midweek across much of the West, with high temperatures reaching the 90s and 100s and ranging between 5-15 degrees above normal. The strong ridge, extending from the Southwest U.S. into west-central Canada, which produced hazardous heat from the West into the northern High Plains, should begin to weaken and begin to push eastward ahead of a Pacific upper low tracking into western Canada and trailing trough that will settle near the West Coast. Monsoonal conditions will promote daily episodes of showers and storms over the Four Corners states and into the Great Basin under and near upper ridging over that part of the country. Meanwhile, one or more wavy fronts will be on the leading side of Great Lakes into southern Plains mean troughing aloft, leading to multiple days of rain and thunderstorms with areas of heavy rainfall from the southern Plains into the Mid-Atlantic and parts of New England. The Great Lakes and Northeast should eventually trend drier late week as the northern part of the trough moves eastward. Consensus still shows the Atlantic upper ridge building into the Southeast for a time, peaking in strength around Wednesday-Thursday.

The Climate Prediction Center’s 6-10 day outlook (valid July 28–August 1, 2024) favors above-normal precipitation along much of the eastern contiguous U.S. and Alaska, as well as parts of Northwest, with below-normal precipitation across most of the interior West and in parts of New England. Increased probabilities for above-normal temperatures are forecast for much of the contiguous U.S., while below-normal temperatures are likely across the state of Alaska and in southern parts of California and Texas.

.png)

.png)

.png)